The 2020 Top 50 List had the potential to look stunted compared to past years’. With a pandemic shuttering many businesses in the spring and causing many to reevaluate the year’s budget, most owners were more worried about keeping their businesses open than continuing to expand them.

No time to read this article? Listen to it instead!

Thankfully, the carwash industry has proved resilient. Part of this resilience, especially on the automated carwashing side, has had to do with the subscription business model. A recent interview Professional Carwashing & Detailing (PC&D) hosted with Landon Luxembourg, senior analyst at Third Bridge Group, revealed that carwashes that had subscription models during the early stages of the pandemic were more likely to average only about a 10% drop in business, whereas those without them could lose up to 80%.

In fact, according to Steve Gaudreau, president of Brink Results and partner in WashCourse.com, the carwash industry’s transformation in this area is precisely what is fueling its growth. “We’re just getting started in that area, and that is really, really changing the industry, because customers are now coming into carwashes more frequently than they ever did. What does that mean? It’s that more carwashes can be built, because customers are washing their cars more,” he says.

Now that 2020 is coming to a close, we have a better picture of the year and how situations have shifted from a largely uncertain first half to a more optimistic second half.

Growth by the numbers

Last year, we reported a 20% increase in the number of locations in the Top 10 alone (up from 17% in 2018). This year, that number fell to 14%. However, the total number of washes on the list increased 18.8% (up from 16.7% the previous year).

There are a variety of possible explanations for the drop in the Top 10 — the pandemic, fewer large-scale acquisition opportunities and more players entering the market, for example. As Paul Fazio, CEO of Sonny’s Enterprises, puts it, “We saw some companies shut their washes (some voluntarily, others ordered), others paused construction on existing projects, and still others delayed the start of new projects. We saw lending markets hit the stop button until they could figure out what was happening. With that in mind, it is reasonable to assume some deals were either paused or cancelled behind the scenes, simply because of the uncertainty the country was (and still is, to some extent) going through.”

Jeff Pavone, founding partner of Amplify Car Wash Advisors and Commercial Plus, adds, “The pandemic surely played a factor, as we saw M&A come to a temporary halt due to all the uncertainty looming in the market. However, the second half of the year will tell a much different story, with a record amount of deals being completed, especially as both buyers and sellers look to close transactions ahead of the election, which could bring a change in tax law next year.”

Related: Carwash M&A heats up

Indeed, Gaudreau believes that comparing the exact percentage year over year isn’t really what matters; what matters is that the industry as a whole keeps growing. Case in point, the threshold to get into the Top 50 continues to rise. From 2014 to 2019, the threshold to get onto the Top 50 List increased by one each year — starting at six and ending at 11. This year’s list, however, has broken that trend by jumping up two levels to 13 locations.

Fazio remarks, “Thankfully, our industry, especially the express model, came through this very well. That’s why I believe next year’s report will show continued strong investment in the express model.”

As far as how that growth occurs, while there has certainly been a building boom, the experts all agree — buying is still the predominant method of obtaining carwashes, and as long as the economics work, it will probably remain the preferred growth option. As for where that growth is occurring on the list, you may be surprised.

A shift in the Top 5

While the names in the Top 5 haven’t changed in the past few years, there was a slight shift in rankings this year. Since International Car Wash Group (ICWG) made it onto the list in 2017, there has been a back-and-forth battle between it and Zips Car Wash for the No. 2 slot. While ICWG took that honor when it suddenly jumped onto the list in 2017 (after its acquisition of Goo Goo Express Car Wash, which held the No. 4 position in 2016), Zips took the lead for the past two years. This year, however, ICWG has edged ahead once again.

ICWG has not only made plenty of new-build and acquisition news in 2020 (with a 69-location gain over last year — the largest on the list), but it itself was acquired by Driven Brands in August. Driven Brands is the parent company of a host of well-known automotive maintenance chains, including Meineke Car Care Centers, Maaco, Take 5 Oil Change and more. One can imagine that with such a parent company backing ICWG, its presence will only continue to grow.

Like ICWG, Zips succeeded in making it past the 200-location mark this year. And, in May, Zips joined the group of private-equity (PE)-owned carwashes by partnering with Atlantic Street Capital, highlighting that its focus is to grow nationally.

In light of ICWG’s huge number of gains, one might expect such high numbers to be reflected in the other Top 5 listings. Not exactly — though the numbers are still impressive. Mister came in next with 20 additions, Quick Quack added 16, Zips added seven, and Autobell rounded out the list with another three locations.

The runners-up are gaining ground

However, the real changes to the list weren’t so much in the Top 5 as they were in the Top 10. In particular, three companies are quickly gaining ground on the climb, and it’s likely only a matter of time before there’s a new entrant into the Top 5.

Tidal Wave Auto Spa, ranking at No. 6 this year, jumped up three rankings with an impressive 29-count jump. Yes, that’s more than Mister and second only to ICWG’s massive gain. Right on Tidal Wave’s heels, Tommy’s Express Car Wash (which offers franchise opportunities and claims it has over 200 sites currently in development in the U.S. and abroad) jumped up eight rankings to No. 7 with a 28-location gain. This chain has been regularly acquiring or opening multiple stores across the U.S. every month. Finally, Mammoth Holdings acquired 16 locations, pulling itself into the Top 10 at No. 8 after coming in just shy at No. 11 last year.

Fazio says, “I do think there will be some change in the Top 5 over time. I think the change will simply take place because some companies are growth-focused and will continue to be very aggressive, while others are growing at a normalized pace as they develop their infrastructure. Or in other cases, some are very regionally focused with no desire to go national.”

Pavone seems to agree, noting that in relation to those in the Top 5, “We are finding several newer, private-equity-backed groups growing much quicker and seem to have an appetite to continue to grow. In addition, we are seeing some regional brands developing out at a record clip and moving outside their market, so it wouldn’t surprise me [to see a couple companies in the Top 5 become displaced].”

To illustrate Pavone’s point, one need only look at the list. In terms of being growth-focused, some of the carwashes that newly appeared on the list this year, such as Champion Xpress Car Wash (which includes sister company Dale Shine Xpress Car Wash) and ModWash, have indicated intense development plans over the next few years. According to Carwash.com, Champion Xpress (No. 26), for instance, plans to build 50 locations from the ground up by the end of 2022, and ModWash (No. 28) hopes to open 100 locations by the end of 2023.

In addition, GO Car Wash, which entered the market in early 2019 and was just a little short of getting onto last year’s list, zoomed up to No. 14 this year and already has 34 locations. These three examples show how, even during a year like 2020, there is still huge growth potential for carwashes — and some companies are taking full advantage of it.

Eric Wulf, CEO of International Carwash Association (ICA), acknowledges the growth but takes a slightly different view, saying, “I wouldn’t expect for there to be major changes in the Top 5 players if we’re only looking two or three years down the road — they have built a substantial lead over their competitors (they represent nearly 45% of the total locations). But, in terms of percentage growth, I would expect the middle and lower tiers to be leading the way.”

Gaudreau forecasts that in a couple years, the entire makeup of the Top 10 will change drastically; while there are only four companies with over 100 locations now, he believes all 10 will soon have over 100 locations and that the largest “mega-firm” will grow to have 500 locations.

That being said, Gaudreau points out that two-thirds of the entire Top 50 List is still family-owned. Most of those companies appear in the bottom half of the list, and, while they are still growing, they are doing so at a slower pace, perhaps only gaining one to two locations a year, if any. As such, Gaudreau admits that the percentage of family-owned businesses will likely start decreasing on this list. Many of them, for instance, have slid off the Top 50 but would still be ranked in a “Top 100” type of list.

Of course, where there’s growth potential, you can be sure to find PE lurking on the sidelines, searching for opportunities.

The rise of private equity

“Most of the large institutional owners in this space are well-capitalized, which is why we expect that this trend will continue, and most markets will eventually be controlled by private-equity-backed firms or large regional operators. We fully expect the number of family-owned operators to decrease over the coming years,” Pavone predicts.

And, looking at the Top 20 alone, just over half of the companies are backed or owned by PE. But, rather than fearing a mass consolidation of the industry, carwashes of all sizes should be reassured that there’s still plenty of room for them in the country. The trend simply shows that, due to the availability of capital, PE-backed companies will grow more quickly than family-owned ones.

“Yes, I believe we will continue to see growth in our industry by PE simply because the ROI is too great to pass up. But there remains a huge opportunity for small (and very large) families to enter our industry and do very, very well for themselves,” Fazio asserts, noting that his business’ data suggests that most carwash companies have less than five locations. “The Top 50 largest operators in our industry only account for about 20% of all tunnels, and less than half of those companies are PE-owned. Flip that around, and it shows that over 80% of carwash locations are privately owned and operated outside of PE.”

Fazio goes on to say that most industries label “major players” as having at least 5% of the market share — which none of the companies on our Top 50 List do. According to ICA’s estimates, there are 62,668 carwashes of all types in the U.S. By that reckoning, Mister Car Wash alone has only 0.5% of the market share (and only a 2% market share of conveyors, which ICA numbers at 17,487).

As such, Wulf says, “I don’t think this foretells the end of the family or independent ownership models. The carwash business is still local, and companies with ‘A’ locations and ‘A’ operations will remain successful — and perhaps increasingly so, given that we believe total demand continues to grow.”

However, there is no denying that PE has turned its eye towards this industry and sees an opportunity too good to pass up. As such, there’s a new trend appearing on the list: the platform model.

The rise of carwash platforms

It’s important to understand the distinction between PE models. As Gaudreau explains it, there are three types at work in the industry. On one side of the spectrum, you have the firms that buy a carwash and remove the owner and, likely, the key managers as well. These firms rebrand the acquired carwashes without question. Then there are those in the middle of the spectrum, where the original owners get involved to some degree, but it’s largely pick-and-choose, and the new washes still usually get rebranded. On the opposite side of the spectrum, however, there are platforms where individual owners not only get to stay with their acquired carwashes, but they also get to keep their own brands. Thus, many brands are represented by one umbrella company. This model lessens the capital investment on the parent company’s part, because there’s no need to rebrand everything. It’s this model that keeps appearing more and more on the list.

There are, in fact, several advantages to these platforms. Pavone explains, “I think this is a good idea for some of the smaller operators. It gives them access to capital to grow, and it establishes a scalable operating platform utilizing best practices. This is extremely desirable for buyers. In the event of an exit, they have a better opportunity to monetize the platform’s infrastructure by receiving a higher price multiple.”

However, Gaudreau notes that there can be one major negative about this model. “Some of these firms are doing it just because they want to collect as many carwashes as they can; they don’t want to invest any money back in single branding or trying to develop the company to any degree. They just want the owners to keep doing what they’re doing, and at a certain point, they’re looking to turn around and flip it to a larger player. So, if you’re going to flip it to a larger player who’s going to rebrand it, why spend a lot of money rebranding?”

Regardless of the umbrella organization’s motive, these companies work by keeping the locally reputable names of their washes.

“I think this [trend] is reflective of the fact that the carwash business remains largely local,” Wulf elucidates. “Until there is such brand recognition that ‘carwash X will bring a value proposition to my town that is stronger than anything else we have,’ I don’t think the brand will be as important as the location and the operational excellence.”

Staying regional

With the amount of capital flowing into the carwash industry, aggressive consolidation and record development will likely continue. This might spark the question: How long until some of these chains go national?

The truth is, even the “national” chains on this list that brand under one name, such as Mister, Zips or even Tommy’s Express, aren’t considered national players — they’re still regional, insofar as many of them congregate in specific city-level markets. Consider that Mister’s largest city-market is Houston, with over 30 locations. Then there’s Crew Carwash (No. 13), which only has locations in Indiana and congregates primarily in Indianapolis, where it has over 20 sites alone (a little over two-thirds of its total count).

“There’s actually very, very few markets in the country where there is a huge, strong regional brand. But the ones that are — that’s a tremendous advantage in terms of volume,” Gaudreau notes. He goes on to say that it will probably be another decade before any brand becomes “national,” and even then, he doesn’t believe there will be more than a couple.

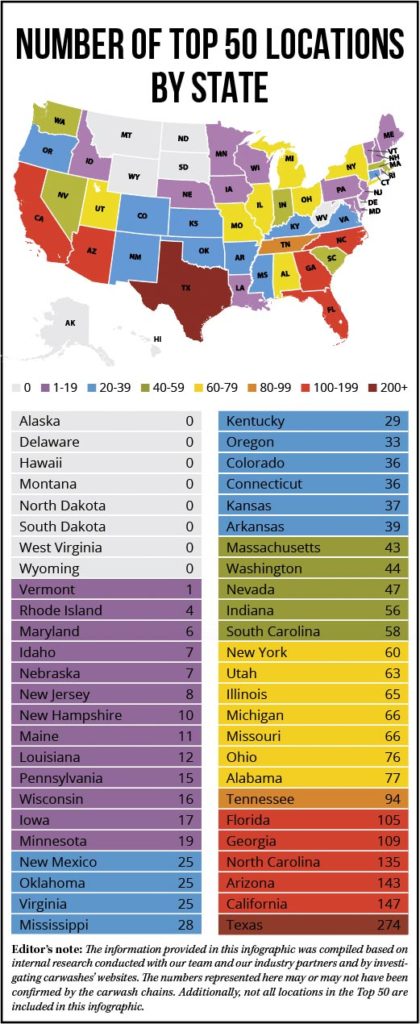

In fact, by looking at the Top 50 List, only 16 companies have a presence in five or more states. And yet, 14 companies still have a presence in only one state. (In case you are interested, there are six companies straddling two states, seven in three states and another seven in four states.) As you can imagine, most of the “five plus” companies are in the Top 10, while most of the one-staters are in the bottom half of the list. However, even most of those in two, three or four states usually choose sites in adjoining states.

“I suspect that brand recognition will be increasingly important in a market, but regional awareness — and certainly national — will remain uncommon,” Wulf forecasts. “In a given market, there is value to a customer to having multiple stores with the same brand if they can be assured of a consistent product — or especially if their subscription allows them to access a network of locations. But, since the majority of driving is due to commuting or running regular errands, having brands in other cities isn’t as meaningful to most customers.”

Fazio adds, “As various brands are purchased within a market, it will often make sense to switch all locations to the most dominant brand in that market over time. But, if you are buying washes with a great reputation in different markets, it may make sense to leave the brands alone until the territories are close enough to give you an advantage by rebranding under one name.”

Just eight years ago, it was big news when Mister Car Wash broke the 100-location mark. While it seems like a lifetime in some instances, it hasn’t even been a decade yet. We are still in the infancy of growth for the industry, and there is still much more to come.

“We are living through the most amazing period of growth in this industry’s history, and this annual ranking gives us time to both reflect where we were and envision where we may go next,” Wulf concludes. “No less impressive than [these] numbers are the innovative people and companies that continue to drive us forward.”

Want more insight into the 2020 Top 50 List? Listen to Steve Gaudreau’s full interview for this article below!