The 2010s have seen a significant transformation in the carwash industry. Just think: At the beginning of the decade, the country was still reeling from the Great Recession. The modern, automated express exterior model was just starting to hit its stride after being introduced in 2001. Today, however, the express exterior market is the hottest thing in carwashing, and it’s causing investors to pour in like never before.

No time to read this article? Listen to it instead!

Then and now

In 2010, there were only 861 carwashes in total represented on our Top 50 list. During the last nine years, almost 1,000 locations have been added to that landscape, totaling 1,837 today. A decade ago, the top chain boasted 72 locations, while the smallest chains on the list had seven each. Although the threshold to make it onto the list has only crawled up by four since then, the threshold to get into the top five is now even greater than the number of locations the 2010 top chain boasted. In fact, the 2010 top five looked very different from what it is today: Wash Depot (72), Autobell Car Wash (46), Mace Security (41), Mister Car Wash (39) and Mike’s Express Car Wash (35).

Yes, there was indeed a time when Mister Car Wash was not at the top of our list. In fact, Mister didn’t take the top spot until 2012, but it has since remained there. However, it is important to note that of those top five, four of the companies still made it to our list nine years later (Mace Security exited the carwashing industry in 2013).

“I think it’s interesting … that privately-held companies are still very high on the list. So, we’re starting to see the influx of institutional money. It’s impacting business, but the vast majority of the owners are still very much family-run, private money. There’s still a lot of opportunity. When you look at the Top 50, if you’ve got more than 10 washes, you’re automatically in. You don’t have to have very many to hit that … list. I still get kind of surprised by it. It’s amazing. It’s still very much a smaller unit industry.” — David Begin

Furthermore, Mister and Autobell are the only companies still in the top five, but they are prime examples of different tracks of growth over the last decade. For example, Autobell now has 84 stores, meaning that it has grown by 82% since 2010. That would be a strong growth statistic for anyone, but for being in the top five for the last decade, Autobell’s growth has been more conservative and controlled than other recent top players.

In contrast, Mister Car Wash broke the 300 barrier this year with 318 locations reported for our list, meaning that it experienced a whopping 715% increase in growth in the last decade. While Autobell remains a family-owned company, Mister has had private equity owners since 2007, according to its website. It just goes to show that two top chains can have vastly different approaches to growth and still be very successful in their own rights.

If you build it, they will come

Last year, we reported a 17% increase in the number of locations in the top 10 alone (down from 32% in 2017). This year, that number has grown to 20.5%. According to our experts, this simply indicates a drop-off in the hyper-growth of a few years ago, when larger acquisitions were the norm; however, the industry is still experiencing steady growth and will continue to do so. Carl Howard, chief operating officer of Autobell Car Wash, explains, “I believe there are fewer carwashes available for purchase that the top 10 purchasers desire. So, many of them have gone into developing carwashes, which takes more time than a purchase.”

Jeff Pavone, principal and partner at Commercial Plus LLC and CP Capital Advisory Services, seconds this sentiment, adding, “Anybody that is anybody in the [carwashing] space — they’re all building new sites. If there are guys that own 10 carwashes that are having any success at all, nine of them are building something new.”

Pavone notes that there are a couple primary reasons for this surge in new development:

- Selling potential. For instance, Pavone says, if you build a carwash for $4 million and can get it up to $800,000 EBITA, and somebody’s willing to pay nine or 10 multiple to purchase it, you’ll walk away with around $4 million in profit. With owners now realizing how much carwashes are worth, many are wondering: Why not build more?

- Faster profits. Due to memberships and subscriptions, well-run carwashes can now be in the black within 90 days of opening. “What you’re seeing from operators today and these chains is they can’t build fast enough, because they are absolutely printing money [due to] going in the black so quick,” Pavone notes.

Of course, with so much demand, costs have risen as well. While costs will vary around the country due to the price of land, construction and permitting, Paul Fazio, CEO of SONNY’S The CarWash Factory, notes that the recent roaring economy means contractors and sub-contractors are extra busy, so they’re asking for a premium to take jobs and taking longer to do them. Labor, if you can find it, also costs more. In addition, even if you are not buying building materials from China, tariffs have made companies source here in the U.S., thus adding to the demand and driving up prices.

But the costs to build a tunnel — easily 10% higher than they were a couple years ago — are not impacting people’s decisions to build, and our experts forecast that 2020 will be an even better year for construction than 2019. The average starting cost of a tunnel, for instance, is around $3 million to $3.5 million; however, the average cost of tunnels built is probably closer to $4.5 million — and owners will easily pay twice these amounts if the economics work for them. In addition, owners are now building bigger tunnels, so the prices rise respectively.

“We still have several more robust years of growth. I still think the technology side of the carwash business is going to continue to change and evolve, and it’s a game changer. I think you’re going to see a lot more technology advances to make it much more efficient to track customer habits and be able to serve them better. So, it’s making carwashing a real business from outside of the tunnel. It’s easier to scale because you’ve got a lot more technology.” — Jeff Pavone

“Building carwashes is a lot more expensive now than it ever has been, and [prices are] continuing to increase, but that’s not slowing people down,” according to David Begin, host of “The How of Carwashing” podcast, past president of the International Carwash Association and former owner of Wild Blue Carwash. “Typically, a lot of that has to do with tunnel length and the cost of land. People have access to a lot of capital, so whether it’s $4.5 million or $4.8 million, people are not flinching because it’s another 5% to 10% more money.”

As with construction, Pavone is optimistic that 2020 will also see more activity than 2019 for mergers and acquisitions. In particular, he notes that many sellers are realizing they want to either take cash off the table or position themselves competitively against chains in the region.

Howard too surmises, “I think that one or more of the larger chains may merge in the next year or so, and I wouldn’t rule out an initial public offering (IPO) as well.”

Land of opportunity

Where exactly is all the expansion happening, though? The answer: everywhere.

According to the experts, the entire country is a hotbed of growth. While macro-level regions are still important to individual companies, it’s the micro-level community — and what defines an “acceptably sized community” for a carwash — that is changing.

Traditionally, Pavone states, there was a kind of formula tunnel carwashes were using when determining where to build: There needed to be so many people within three miles and so much traffic passing by per day. However, companies are now looking in towns perhaps only 20,000 people strong where there may not be much density for 10 miles around, but as long as they’re situated next to a larger retailer, like a Walmart, they do just fine. Many carwashes have found tremendous opportunities in these smaller towns and cities.

“I believe there is still enough white space in this niche of the industry to get excited about. You just have to be willing to find it and take advantage of it,” Fazio says. “We are seeing more and more companies that are willing to open or buy washes in any area as long as they believe that market can hold five to 10 more units, giving them reason to make that investment.”

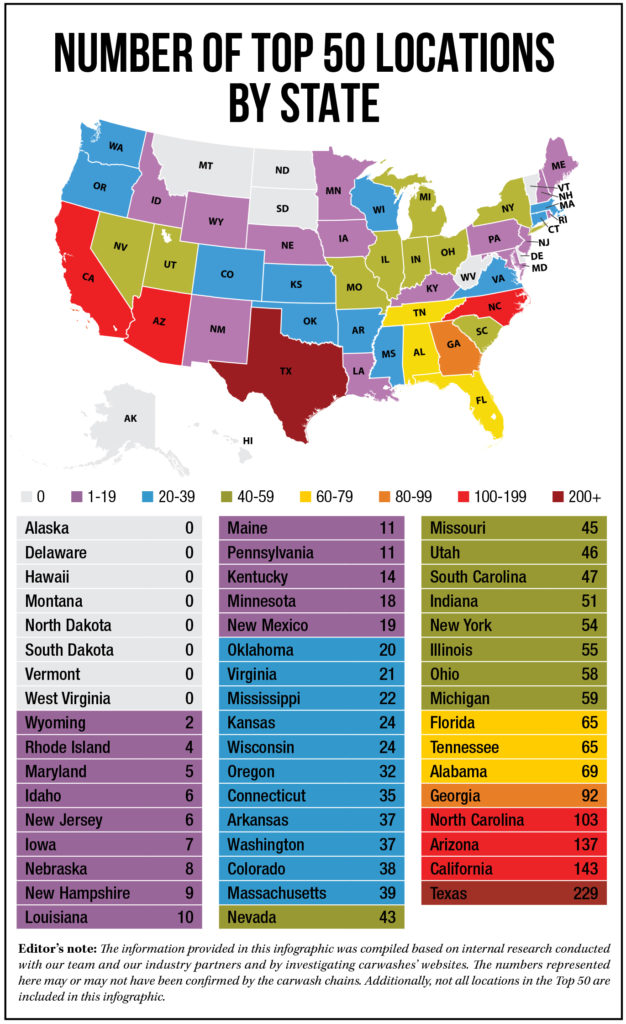

A look at this year’s Top 50 map indicates how this trend is emerging. Overall, it shouldn’t come as a surprise that the Top 50 presence is heaviest in the Southwest and Southeast. Traditionally, there has also been a strong Midwestern presence east of the Mississippi River, and while those numbers have continued to grow, they are now also increasing in states west of the river, particularly in more southern states like Missouri and Kansas.

Oversaturated markets: Are we there yet?

Another reason carwashes should be looking outside of the larger metropolises is the threat of oversaturation. For instance, Pavone believes that Phoenix is perhaps the most saturated city in the country when it comes to carwashes, but he’s not convinced that it is oversaturated — yet.

“I’m not sure the consumer has raised the flag and said we’re saturated, because the consumer has changed,” Pavone states, explaining that customers not only prefer more convenience and efficiency nowadays, but they are also washing their cars more than once a month.

Begins muses that perhaps we still don’t know what oversaturation looks like for this industry. “I think we saw that back in Detroit in the 2000s, where people felt like there was oversaturation, but with the advent of the unlimited wash club, it’s really changed the dynamics of how we wash cars and how many cars we wash.”

Unlimited wash clubs have, in fact, truly revolutionized the express model. They have enabled carwashes to not be so dependent upon good weather for profits, and they have eased the customer’s mind about the value of a carwash and the threat that subsequent bad weather will decrease that value. Since weather is no longer such a factor, Begin states, “Where people have traditionally tried to go to the Sunbelt to build tunnel washes, I think now … there’s going to be opportunities for people that choose smartly in the Midwest and the Northeast.”

At the same time, Pavone notes that smaller operators in heavily saturated areas will be the ones to suffer in the case of monthly memberships. After all, if one chain has 40 locations in an area and another only has a couple, where is the customer going to go?

“I like the growth our industry is experiencing. It’s certainly changing at a rapid pace. The challenge for us all is to pick and choose the best options and ideas for each of our companies. There is room in most of the country for continued expansion of the industry. As we grow, it will be imperative for each of us to differentiate ourselves from our competition, so that the customer sees a clear distinction between you and your competitor. And, hopefully, that distinction is what keeps them coming into your business.” — Carl Howard

However, just because we have not reached the breaking point doesn’t mean we should keep going full-steam ahead in certain areas. Concerning saturation, Howard explains, “The obvious danger is that there isn’t enough volume to support all the investments, and some will close as a result. Additionally, if enough sites close, it can become difficult over time to get good sites financed, as some banks could decide carwashes are too risky to finance.”

Granted, it is impossible for anyone to know what is happening in every market, and more and more companies are keeping their expansion plans secret until they have no choice but to reveal them. In addition, the speed at which this industry is moving is not helping the issue.

Nevertheless, Fazio warns, “Oversaturation is the one thing I believe can kill this industry. It takes a good amount of capital to build a tunnel wash. Assuming the goal is the best return-on-investment possible, why on earth would you build next door to a wash when there is still so much white space out there?”

The Davids and Goliaths

The carwash industry is still very fragmented and absolutely dominated by mom-and-pop operators. Slowly, though, larger chains — some backed by private equity and some not — have begun to change the face of the industry. But, according to the experts, it’s all for the better.

“So, the market is still very mom-and-pop. What these investors have done for the industry over the last 20 years is redefine the look and feel of carwashes. Everyone has been forced to make sites much more ‘retail’ looking than ever before. … As for the state of the industry, I believe we are about to see another gear change. As fast as the pace the last five years has been, I believe the next five to 10 years will be even more exciting. Hold on — the best for us all is yet to come.” — Paul Fazio

“Being a small operator, I was concerned about institutional investors, but I think institutional money … will make the overall industry better.” Begin states. “It’s not like an institutional chain has some sort of magic formula to take away all the customers from a mom-and-pop. If you’re executing well at your carwash, you’re going to do fine.” He adds that institutional chains and smaller companies tend to take different approaches to operations, neither of which may be right or wrong, but both types can come out successful in the end.

Furthermore, competition is beneficial to the industry, because it forces everybody to improve their processes and offerings. In any case, the consumer wins by receiving better experiences and more access.

“There will be smaller operators in our industry for a very long time,” Howard concludes. “The top-branded tire stores still only have about 20% of the tire business, and there have been tire stores as long as there have been cars. However, consolidation will bring branding to our industry, which is a good thing. As consumers recognize regional or national-branded carwashes, they will be drawn to wash more frequently. Operationally, there will be some standardization brought by the consolidators that may be mimicked by the smaller operator.”

All in all, there’s still much more opportunity for the industry, and there are still a few years of high growth, consolidation and development ahead.