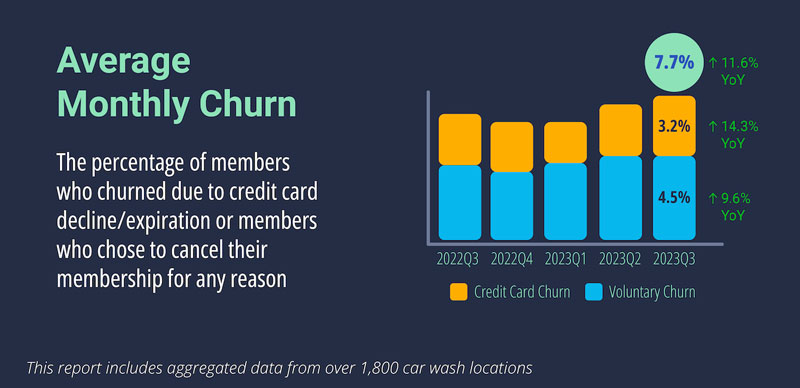

Each quarter, customer relationship management company Rinsed releases a “Car Wash Industry Report,” which highlights key performance indicators around carwash membership. The company shared its Q4 results with Professional Carwashing & Detailing and offered some insights into the report’s methodology and thoughts on this quarter’s findings.

This Q4 report covers Q3 2022 to Q3 2023, which is July 2022 to September 2023. The dataset includes carwash businesses of all sizes in the market, adds the company. Similarly, all regions of the U.S. are represented and all locations included in the dataset are tunnels that offer membership programs.

According to a company representative, Rinsed has application programming interface (API) access with five major point-of-sale providers in the professional carwashing industry, allowing it to extract data throughout the day. Then, as explained by the rep, Rinsed uses a data warehouse and standard data transformation tools to transform the data, so that it matches what is seen in the point-of-sale. This allows any number of calculations to be performed on the transformed data.

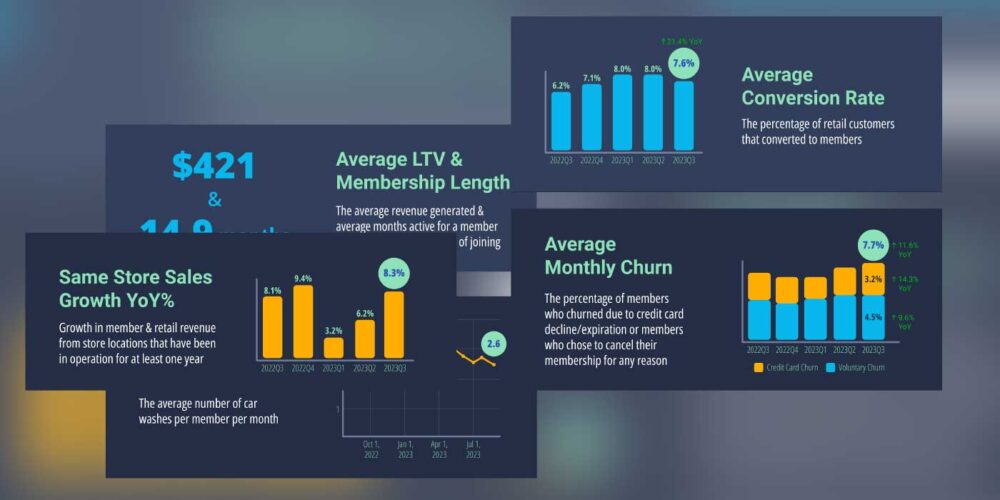

“Overall, we were excited to see same store sales bounce back in Q3, with close to double-digit growth for the first time since 2022. This rebound was driven by a recovery in the retail segment, which was down in the first half of the year, along with continued strength in membership sales,” explains Austin Esecson, co-founder and CEO of Rinsed.

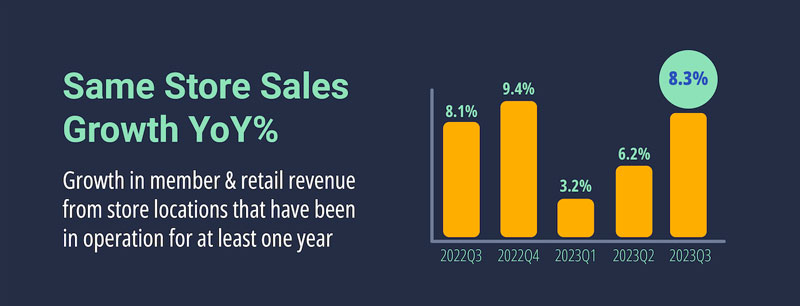

Furthermore, adds Esecson, the positive trend in conversion rate suggests that there is still plenty of room for membership growth and that increased competition does not reflect an overall market saturation.

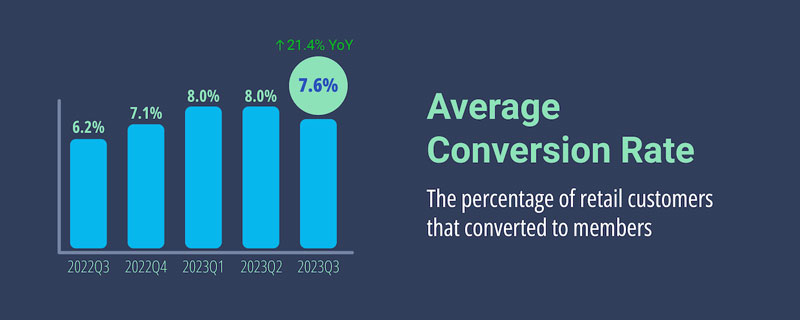

“We have seen increases in both voluntary and involuntary churn, with consumers possibly looking to cut expenses. It’s more important than ever for operators to make it as easy as possible for customers to remain a member, and not introducing friction when members want to update their credit card, switch their plans, etc.,” continues Esecson.

Regarding lifetime value (LTV), the company believes this number will probably surprise a lot of operators and is likely higher than what they are using internally.

“Historically, it’s been really difficult for operators to follow members through their entire lifecycle (with members switching plans as well as leaving and rejoining), resulting in an underestimate of lifetime value. We believe the over $400 lifetime value of a carwash member is further evidence that operators are chronically underspending on customer acquisition today,” concludes Esecson.

You can access future reports at www.rinsed.com/subscribe.